Number Go Up by Zeke Faux

The crypto craze was at its peak a few years ago. Now is a good time to look back, laugh and maybe even learn something.

You might be sick of hearing about crypto at this point. Many of us filtered out anything crypto related during the hype years and have permanently stopped listening. Nobody seems to understand what crypto (or NFTs or stablecoins) is for, yet for a few years, many people seemed to be making fortunes on the continued rise of their “assets”. Now that most of the Ponzi schemes have been outed, and all the key players have been convicted of fraud, there seems to be little reason to revisit the mania.

Zeke Faux argues that now is the perfect time to take stock of what happened. Crypto was one of the biggest bubbles in history. And while it shares a lot of features with other bubbles - like real estate in 2008 and the dot-com boom - it’s much funnier and stranger than them. Number Go Up is a history of that weirdness. Everything dumb you think happened to people in crypto, actually happened, and more. In 2021, The President of El Salvador announced that Bitcoin would become the country’s official currency:

One American Bitcoiner I met in San Salvador told me, semi-seriously, that he’d stimulated the economy by buying a refrigerator for the family of a stripper he was dating. A Bitcoin evangelist turned [adviser to the prime minister of El Salvador] pulled out an actual ruler to make some kind of argument about how the price of Bitcoin was sure to go up, even though it was going down dramatically at the time. “Think of Bitcoin like a ruler,” he said. “The reason number goes up is the ruler is a fixed size.”

Number Go Up is full of seemingly serious people acting in bizarre ways. Somehow crypto manages to pull at all the strings that make humans poor decision makers. Gambling has always been addictive, and crypto is gambling without having to pay the house. Like cults, it makes promises of a future utopia that is vague enough to not be falsifiable. And like conspiracy theories, the less things make sense from a conventional perspective, the more real they are for the true believers.

The core idea of cryptocurrencies has some merit. In theory, they remove the need for trust in financial transactions. In the traditional system, banks are the locus of trust. Most people don’t worry whether they actually have the money in their account that the bank claims. Banks are highly regulated and most savings accounts are secured by the government. With Bitcoin, there’s no need for people to have trust in a single institution. Ledgers and balances are maintained by all users in a decentralized “blockchain”. Computers, guided by an immutable algorithm, determine who gets how much.

One problem, among many, is that none of those benefits actually exist. Yes Bitcoin exists on a decentralized ledger, but you still need to trust an exchange, like the now-bankrupt FTX, to get access to your crypto. If someone steals your credentials, your money is gone forever. The algorithm might be all powerful, but it also chews up as much electricity as a medium sized country. When millions of new customers rushed to get their hands on anything crypto-adjacent, new coins and exchanges rose to meet the demand. But many were blatant scams that took in customer money, shut down operations and left.

Bitcoin, and crypto in general, may have seemed like a promising technology a decade ago. But most new technologies, especially ones with the vast financial backing of venture capitalists, develop real life uses quite fast. Not so with crypto. Faux sums it up nicely:

Thirteen years had passed since Bitcoin was invented—about as long as it took to get from the first websites to the iPhone—and the best argument anyone had for Bitcoin was that it was a financial bubble that would just keep growing forever?

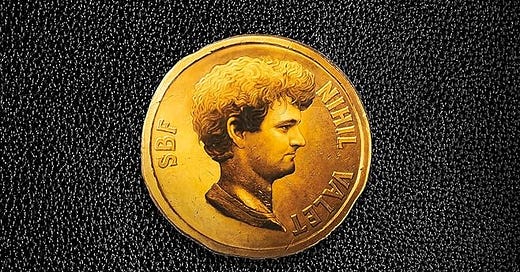

Number Go Up is a lot of fun precisely because many of us felt all along that crypto was a fool’s game. It took longer than we expected for things to blow up. But when they did, the aftermath was hilarious, in a chaotic way, and Faux was there to document it. Of course, some will say that crypto will be back, and it’s true that Bitcoin has again increased in value, but it’s clear that much of the community around crypto is rotten to the core. When all the key people involved in an endeavor are this suspect - Sam Bankman-Fried guilty on all accounts, Changpeng Zhao ousted from Binance, the founders of Tether on the run - how optimistic are you about its future?

Other things I’ve read

Michael Lewis defends Going Infinite, which I reviewed a few weeks ago, in an interview with Freakonomics: Why are People so Mad at Michael Lewis?

Mick Herron has written some of my favorite spy thrillers in his Slow Horses series. Now those books are being adopted for Apple TV+ and Mick Herron’s unlikely career continues to trend upward.

Elon Musk’s Twitter takeover has been a constant source of drama. The Verge collected some of the weirdest and funniest tweets as a sort of obituary for the service: The Great Scrollback of Alexandria.